[ad_1]

Weekly Technical and Basic Evaluation of Gold – March 24

The worldwide gold ounce managed to set a brand new and historic document for itself and its supporters by the week ending March 22. Nonetheless, from the second half of final week, international gold started to say no or, higher mentioned, corrected itself.

The primary motive for gold’s return to the draw back was robust knowledge from the US that induced all speculations concerning the begin of the Federal Reserve’s rate of interest discount course of to decrease.

Final week’s occasions for gold:

Final week, on the primary working day of Forex, the worldwide gold opened at a value of 2156 and went as much as 2163 {dollars}; the truth is, the worldwide ounce ended its first day in a peaceful and low volatility state.

The primary motive for this session’s inactivity was the necessary assembly of the Federal Reserve on Wednesday, the place the entire market was ready to listen to information and statements from Federal Reserve officers.

On Tuesday, gold was in an identical scenario to the day before today and after opening at 2160, it dropped to 2147 and at last closed at 2157, ending its working day.

Then got here Wednesday, the day when your entire market awaited the Federal Reserve’s assertion in March.

Final Wednesday, as predicted, the Federal Reserve left its rates of interest unchanged within the vary of 5.25 to five.5 %.

What was necessary for merchants and your entire market was studying the prediction of the longer term financial scenario of the US, which is legendary for the Dot Plot chart.

The March Dot Plot chart confirmed that Federal Reserve officers are nonetheless anticipating three rate of interest cuts of 75 foundation factors for the present yr 2024. This prediction was in step with December 2023.

The preliminary market response to this information was that the yield on U.S. ten-year Treasury bonds started to say no and had damaging results on the U.S. greenback. The explanation for this response was that merchants began speculating that the Federal Reserve will cut back its charges from June onwards.

It’s price mentioning that the well-known rate of interest predictor device CME Group confirmed a lower within the chance of the Federal Reserve leaving its charges unchanged in June from 40% to 25% earlier than the assertion and studying of the dot plot chart.

Jerome Powell, the Chairman of the Federal Reserve, adopted a comparatively optimistic tone concerning the future inflation outlook of the US in a press convention after this necessary assembly, forcing the greenback to stay below downward stress.

Powell admitted that inflation numbers in January and February have been “very excessive,” however emphasised that these knowledge haven’t modified the general story about inflation discount and he and his colleagues have inferred that this situation is generally because of seasonal results.

Because the promoting of the US greenback elevated within the Asian buying and selling session on Thursday, XAU/USD began its upward rally in the direction of its highest historic document of $2220.

Nonetheless, in a while the identical Thursday, as a result of launch of robust financial knowledge from the US, the greenback started to strengthen towards its rivals, inflicting international gold to start out returning to the draw back.

Additional particulars of the reviews on Thursday are as follows:

- The US Division of Labor reported that preliminary claims for unemployment advantages for the week ending March 16 decreased to 210,000.

- As well as, the World S&P Institute introduced that the US composite buying managers’ index in March elevated to 52.2% within the preliminary estimate, indicating that financial actions within the US personal sector have grown at an appropriate tempo.

- Chris Williamson, Senior Enterprise Economist on the World S&P Institute, commented on the survey findings about PMI: The rising rise in prices together with strengthening pricing energy towards the backdrop of latest demand progress signifies renewed inflationary pressures in March.

- In the meantime, the surprising determination of the Swiss Nationwide Financial institution (SNB) to cut back rates of interest by 25 foundation factors and the damaging assertion from the Financial institution of England’s (BoE) Financial Coverage Committee led to capital outflows from the British pound and Swiss franc.

This necessary issue induced the greenback to rise additional on Thursday.

In reality, two members of the Financial Coverage Committee of the Financial institution of England named Jonathan Haskel and Catherine Mann, who had voted for a 25-basis-point price hike within the earlier assembly, this time voted to maintain rates of interest unchanged at their present ranges, whereas Swati Dingra continued to push for a 25-basis-point price reduce.

Finally, as a result of strengthening of the US greenback general on the final buying and selling day of the week, international gold continued its decline to under $2160 and finally ended the week at $2165.

Gold outlook for the upcoming week:

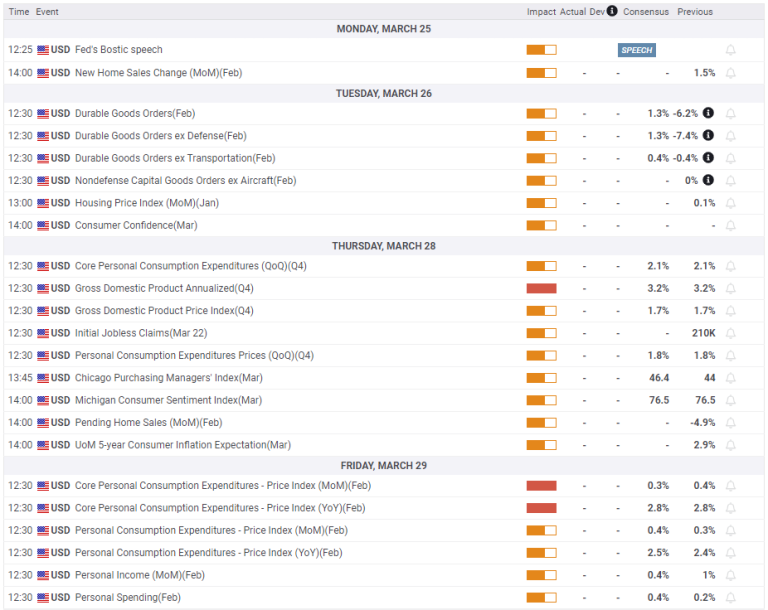

On Monday, with the beginning of the foreign currency trading week, no vital information is anticipated for the greenback and gold, and necessary information is definitely anticipated to start out from Tuesday.

The US is ready to announce sturdy items orders for the month of February on Tuesday, and the Convention Board additionally intends to launch the Investor Confidence Index for February.

The US Bureau of Financial Evaluation (BEA) can also be anticipated to launch its newest estimates and evaluations for the fourth quarter US Gross Home Product (GDP) and Private Consumption Expenditures (PCE) index on Thursday.

What’s the PCE index?

The Private Consumption Expenditures Value Index, generally often called the PCE index, evaluates adjustments in costs of products and companies bought by customers in the US. The PCE index is used to document inflation throughout a variety of client prices and displays their conduct.

Since households are one of many basic elements of the round circulate of the economic system, their decisions and choices relating to consumption are one of the vital necessary or maybe an important facets of financial interpretations.

Needless to say customers allocate a good portion of their earnings to consumption in the course of the yr, and consumption accounts for nearly 70% of US Gross Home Product. Subsequently, the position of consumption and client spending planning within the economic system is essential.

The market expects US GDP within the fourth quarter of 2023 to stay on the earlier determine of three.2%. Keep in mind that market response to this report may be very fast, however its results available on the market shall be short-lived.

Bear in mind, if for any motive this determine is increased than 3.2%, the US greenback will strengthen and international gold will come below downward stress. Conversely, if the reported determine is decrease than anticipated, the US greenback will weaken and gold will begin to strengthen.

It’s true that merchants intently observe the necessary PCE index, however as a result of the US inventory and bond markets are closed on Friday because of “Easter” buying and selling quantity decreases considerably.

However don’t neglect that this response might present itself on Monday with the beginning of the foreign currency trading week.

If for any motive the PCE index is best than market expectations and better than predicted, the US greenback will strengthen on the primary day of the week, which is Monday.

Conversely, if the reported determine is lower than 0.3%, the greenback will weaken and gold will begin to strengthen.

Weekly Gold Technical Evaluation

The worth flooring and ceiling for gold up to now week had been $2146 and $2222. Should you open a day by day gold chart proper now and plot an RSI indicator, you will notice that the height of this indicator is transferring downwards throughout the overbought zone and displaying a worth of 64.

Because of this management remains to be within the palms of market bulls, however international gold has lastly began its correction from its historic excessive.

Moreover, when you draw an ascending channel on the day by day chart at the moment, you’ll discover that international gold, which had exited its channel ceiling, has returned inside this channel.

Key Help Ranges in World Gold Evaluation

If gold is to say no, the primary vital help degree would be the necessary space of $2160. If gold penetrates under this space, the subsequent necessary value degree is $2150. If market bears push gold decrease, the subsequent necessary ranges shall be $2140 and $2130.

Key Resistance Ranges in World Gold Evaluation

If gold will increase, the primary necessary resistance degree shall be $2180. If gold efficiently passes by this space, the subsequent necessary degree is $2190. If market bulls achieve pushing gold increased, the subsequent resistance ranges shall be $2200 and $2222.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. Please seek the advice of with a certified monetary advisor earlier than making any funding choices.

Blissful buying and selling

could the pips be ever in your favor!

[ad_2]