[ad_1]

The markets continued to commerce on anticipated strains. The buying and selling week was brief as Friday was a buying and selling vacation on account of Mahashivratri. Within the 4 buying and selling periods, the markets stayed uneven and did not make any particular and convincing strikes whereas they continued to modestly advance on a weekly foundation. The buying and selling vary additionally stayed slender; the Index oscillated in an outlined 301.30-point buying and selling vary whereas staying devoid of directional bias on most events. The volatility additionally dipped; the India VIX declined by 10.65% to 13.61. By and enormous, whereas not displaying any significant upsides, the headline index closed with a internet weekly acquire of 154.80 factors (+0.69%).

As we head right into a recent week, the markets stay susceptible to consolidation at larger ranges. The Choices knowledge proceed to indicate a buildup of resistance simply above the present ranges. There are sturdy prospects that the markets might present incremental advances, however on the similar time, additionally keep susceptible to profit-taking bouts at larger ranges. A sustained upmove is unlikely and that might occur provided that Nifty is ready to take out 22600 ranges and better. This warrants a powerful vigil at larger ranges; it will be necessary to not solely determine alternatives with sturdy relative power but in addition hold defending income at larger ranges.

Chasing the pattern ought to be finished very mindfully and with strict protecting stops in place. The approaching week is more likely to as soon as once more see a quiet begin to the commerce. The degrees of 22600 and 22750 are more likely to act as resistance ranges; helps are available decrease at 22230 and 22050 ranges.

The weekly RSI stands at 74.52; it stays in a mildly overbought zone. It additionally stays impartial and doesn’t present any divergence in opposition to the value. The weekly MACD stays bullish and stays above the sign line.

A candle with a small actual physique emerged; this denotes the dearth of conviction and indecisiveness of the market individuals at present ranges.

The sample evaluation of the weekly charts reveals that the Nifty continues properly whereas advancing the breakout that it achieved because it crossed above 20800 ranges. Following a breakout from the rising channel, the Index has continued to advance whereas forming incremental highs. The bands have gotten wider; there are prospects that this bulge might kill the pattern and push the markets underneath some consolidation.

There are not any indicators although on the charts that recommend any corrective transfer to occur. Nevertheless, that being mentioned, the technical construction of the charts makes it evident that the markets are on the level of taking a breather. The present uptrend might keep intact or might not instantly reverse, however the Nifty definitely seems susceptible to some consolidation at larger ranges. Whereas we hold following the pattern and search for shares that present improved or sturdy relative power, equal significance ought to be laid on the safety of income at larger ranges. It’s strongly advisable that whereas one might proceed to observe the pattern, successfully trailed stops could also be adopted whereas conserving general leveraged positions at modest ranges. A cautious outlook is suggested for the week.

Sector Evaluation for the approaching week

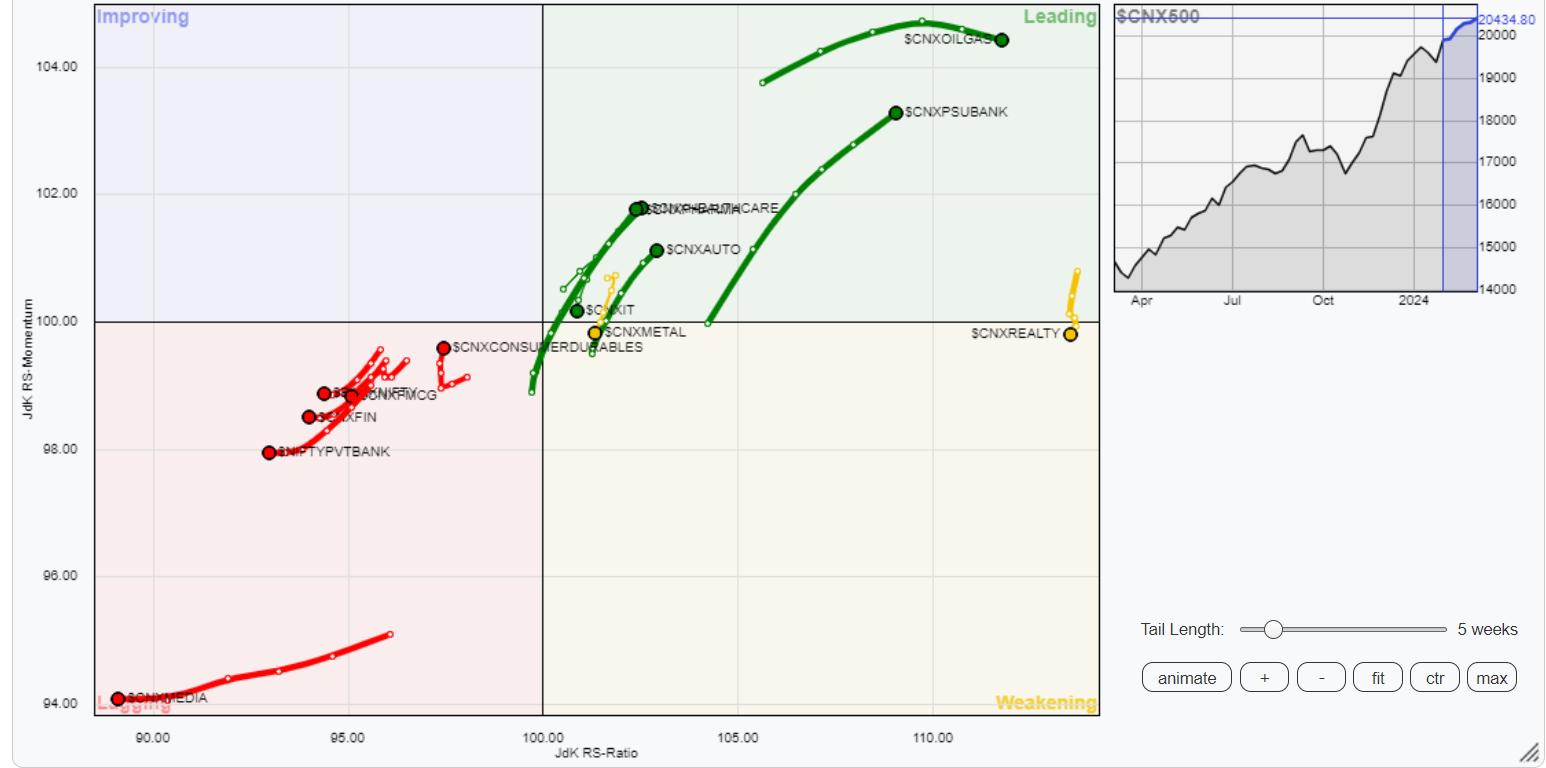

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that whereas staying contained in the main quadrant, Nifty IT, Commodities, and the PSE teams are displaying a slowdown of their relative momentum in opposition to the broader markets. In addition to this, PSU Banks, Pharma, Infrastructure, and Auto indices are contained in the main quadrant and should proceed to comparatively outperform the broader markets.

The Realty Index is again contained in the weakening quadrant and so is the Steel Index. These two sectors together with the Nifty Midcap 100 index which can also be within the weakening quadrant might even see their relative efficiency slowing down whereas they could proceed to carry out on a person foundation.

Nifty FMCG, Monetary Providers, Service Sector Index, Banknifty, and Media proceed to languish contained in the lagging quadrant. The Consumption Index can also be contained in the lagging quadrant however seems to be bettering on its relative momentum.

No sectors are current contained in the bettering quadrant.

Vital Notice: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used straight as purchase or promote alerts.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Shoppers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, at present in its 18th yr of publication.

[ad_2]