[ad_1]

The bullish momentum of the Bitcoin value has dwindled over the previous few weeks, placing the development of the crypto bull cycle into query. On Friday, April 12, the crypto market witnessed a flash crash, inflicting the premier cryptocurrency’s worth to drop from $70,000 to under $67,000.

This newest downturn underscores the battle of the Bitcoin value to return to its current all-time excessive of $73,737, which was solid in mid-March. On-chain analytics platform Santiment has recognized a selected Bitcoin metric that will sign the resumption of the bull run.

Bitcoin Bull Run Might Resume If This Metric Falls

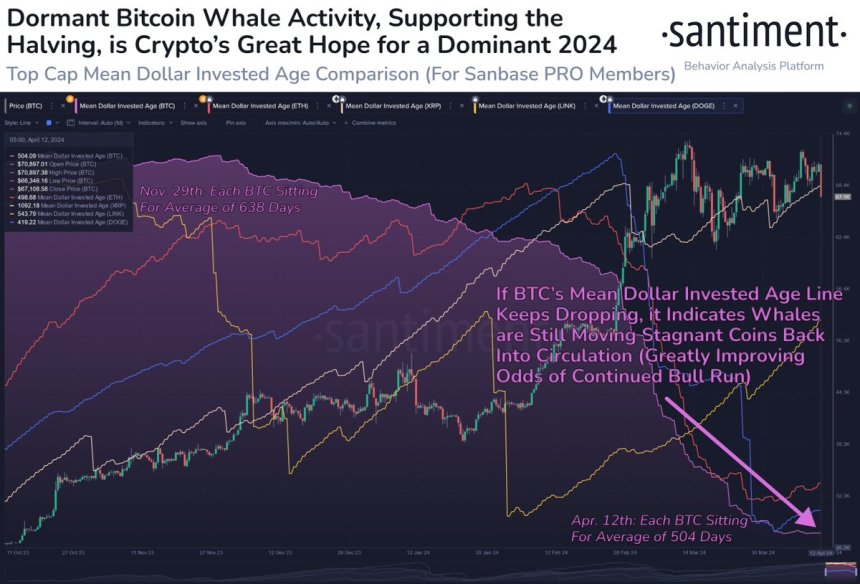

In a current publish on X, blockchain intelligence agency Santiment supplied an thrilling perception into the present cycle and the value efficiency of Bitcoin. The agency pinpointed the Imply Greenback Invested Age metric as one of many indicators to look at because the market chief strikes sideways.

In line with Santiment, the Imply Greenback Invested Age metric tracks the common age of funding in an asset that has sat in the identical pockets. When this indicator is rising, it signifies that investments are getting extra stagnant and previous cash are being held in the identical wallets.

Conversely, a reducing Imply Greenback Invested Age metric implies that investments are flowing again into common circulation. This “falling line” additionally suggests a rise in community exercise.

A chart exhibiting Bitcoin's Imply Greenback Invested Age | Supply: Santiment/X

From a historic perspective, Bitcoin exhibited a falling Imply Greenback Invested Age line through the earlier bull cycles. In line with Santiment, this has been the case for the premier cryptocurrency within the present bull run, which kicked off in late October 2023.

The on-chain analytics platform, nonetheless, famous that Bitcoin’s Imply Greenback Invested Age line has been shifting sideways over the previous couple of weeks. This phenomenon is much more surprising, contemplating that the highly-anticipated halving occasion is a couple of week away.

The Bitcoin halving will see the miners’ reward slashed in half (from 6.25 BTC to three.125 BTC). It’s a bullish occasion that has contributed to the optimistic outlook – borne by most traders – for the premier cryptocurrency in 2024.

From Santiment’s newest report, traders would possibly need to preserve their eyes peeled for the Bitcoin Imply Greenback Invested Age metric. And the bull run is prone to proceed if the BTC’s Imply Greenback Invested Age line resumes its fall, which might suggest that main stakeholders (like whales) are again to shifting cash into common circulation.

BTC Worth At A Look

As of this writing, Bitcoin is buying and selling round $66,548, reflecting a notable 6% value decline up to now 24 hours.

Bitcoin value falls under $67,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal threat.

[ad_2]