[ad_1]

After we coated the BlackRock announcement final week of their new tokenized treasuries fund I assumed it was an enormous deal.

One week in, this new funding car (ticker image BUIDL) is proving to be fairly common. On-chain information reveals that $245 million price of BUIDL shares at the moment are held in seven completely different wallets. That’s the fantastic thing about blockchain information, every part is clear.

The tokenized fund was deployed on Ethereum final week with an preliminary funding of $5 million. The fund holds U.S. Treasuries and repurchase agreements with shareholders incomes yield within the type of BUIDL shares. The value of BUIDL is pegged at $1, like a typical cash market fund.

With BlackRock now concerned, 2024 could possibly be a breakout yr for the tokenization of real-world property (RWA). HSBC has launched a tokenized gold product in Hong Kong and there are a lot of different initiatives around the globe coming on-line.

Tokenization of RWA has had sluggish adoption because it was first imagined a number of years in the past. However now that a few of the greatest monetary establishments on the planet are actively concerned, there’s severe momentum on this sub-niche of blockchain expertise.

Featured

> BlackRock’s Tokenized Treasuries Fund BUIDL Sucks Up $245M In First Week

By Samuel Haig

Buyers have piled 1 / 4 of a billion {dollars} into the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in a single week.

From Fintech Nexus

> Unicorn recipe unveiled in Team8 report

By Tony Zerucha

A brand new report from firm builder and enterprise group Team8 reveals it’s time for fintechs to pursue unicorn standing, offered they do the groundwork.

Podcast

> Julie Szudarek, CEO of Self Monetary on constructing credit score

The CEO of Self Monetary talks in regards to the significance of constructing credit score rating, monetary literacy and the way a credit score…

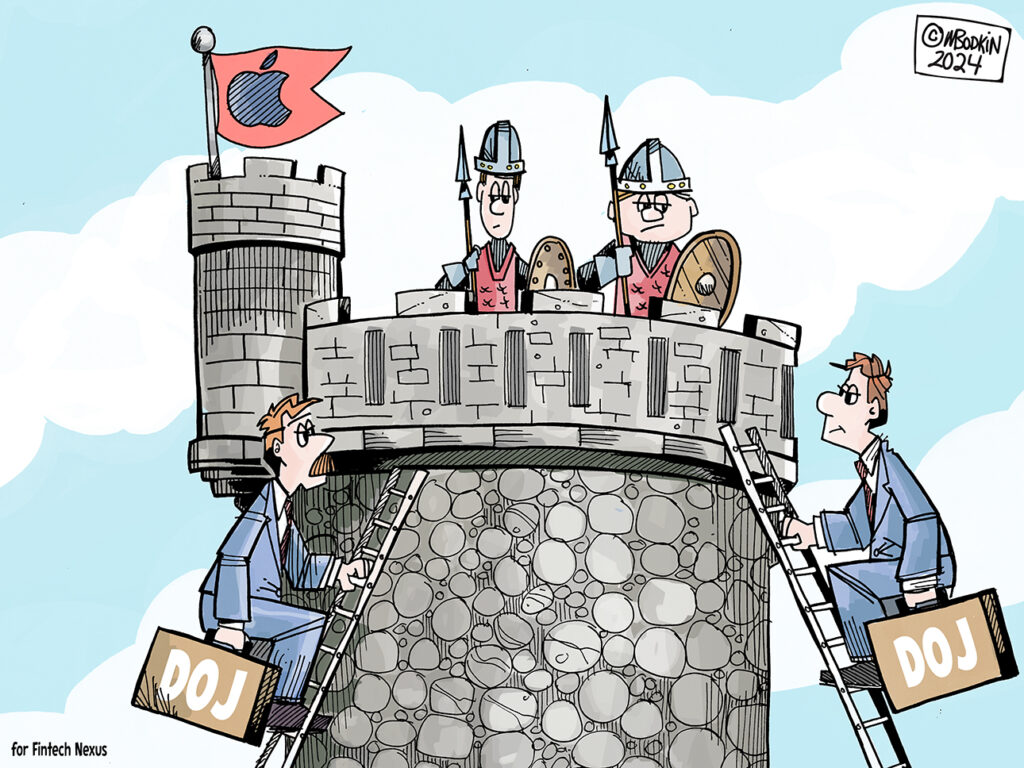

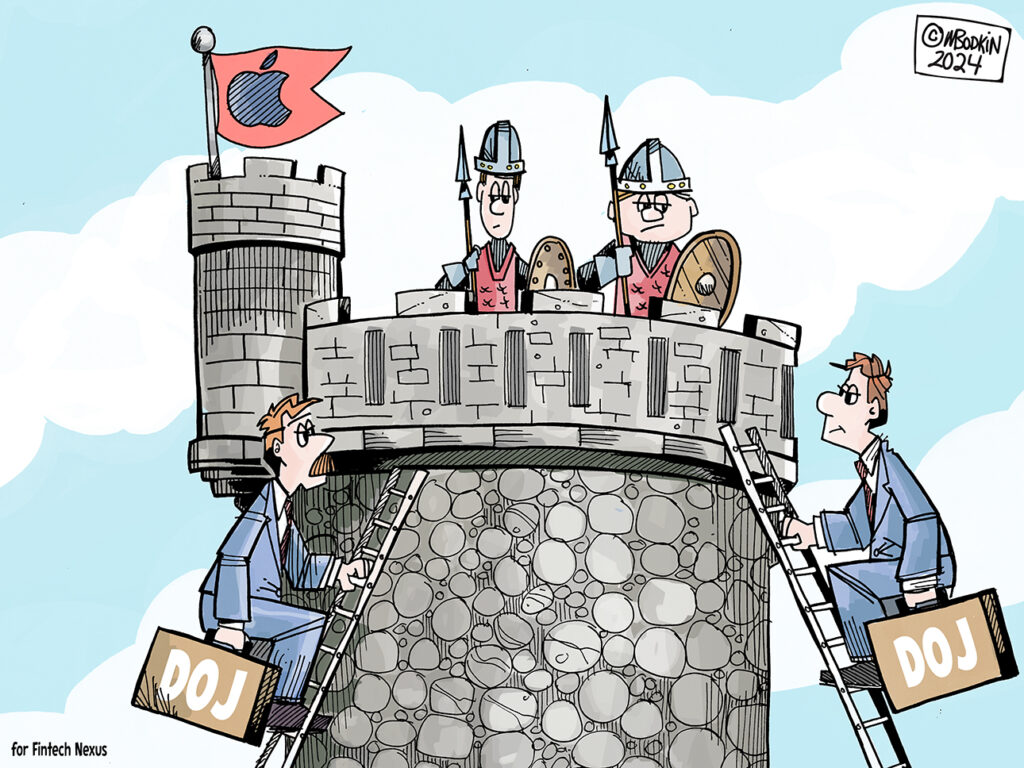

Editorial Cartoon

Additionally Making Information

- USA: Amazon One launches new app to scan your palm for checkout

Amazon introduced Thursday the launch of its new app for Amazon One, its contactless palm recognition service that permits prospects to hover their palm over a tool with a view to buy from choose locations, together with over 500 Entire Meals Market shops, Amazon shops, and greater than 150 third-party places.

To sponsor our newsletters and attain 180,000 fintech fanatics together with your message, contact us right here.

[ad_2]