[ad_1]

Throughout the peak of the 2021-22 fintech VC increase, no sector was hotter than spend administration.

Firms like Brex, Ramp and Navan all raised huge rounds at multi-billion greenback valuations. Whereas the class has cooled off, like most areas of fintech, it’s nonetheless attracting capital from some huge names in enterprise capital.

Coast was based in 2020 and as we speak introduced a brand new spherical of funding: $25 million in fairness and $67 million in debt financing. However it isn’t competing with the aforementioned huge names.

As an alternative, Coast is targeted on what it calls “real-world” companies, those who have personnel and car fleets within the discipline like plumbers, HVAC companies, trucking firms and supply firms.

There may be definitely much less competitors at that finish of the market and these firms may definitely use leading edge expense administration know-how.

It’s one other nice of instance of the verticalization of fintech.

Featured

> VCs double down on fintech Coast, which goals to be the Brex for ‘real-world’ industries

By Mary Ann Azevedo

The expense administration area is a crowded one, with well-funded gamers similar to Brex, Ramp and Navan all clamoring for market share. These firms are usually centered on tech startups and huge companies. However a four-year-old contender, Coast, is pursuing a unique kind of buyer.

From Fintech Nexus

> TruStage delivers Cost Guard Insurance coverage as digital lending insurance coverage answer

By Craig Ellingson

Neither the lender nor the borrower need a mortgage default, now with this progressive new answer from TruStage the chance of default may be eliminated.

> Banking for the Unbanked: How BaaS is Driving Monetary Inclusion

By Nicky Senyard

For the unbanked and underbanked, BaaS means quick access to monetary companies that meet their particular wants. By combining fintech’s method with the capabilities of conventional banks, BaaS fosters monetary inclusion.

Editorial Cartoon

Webinar

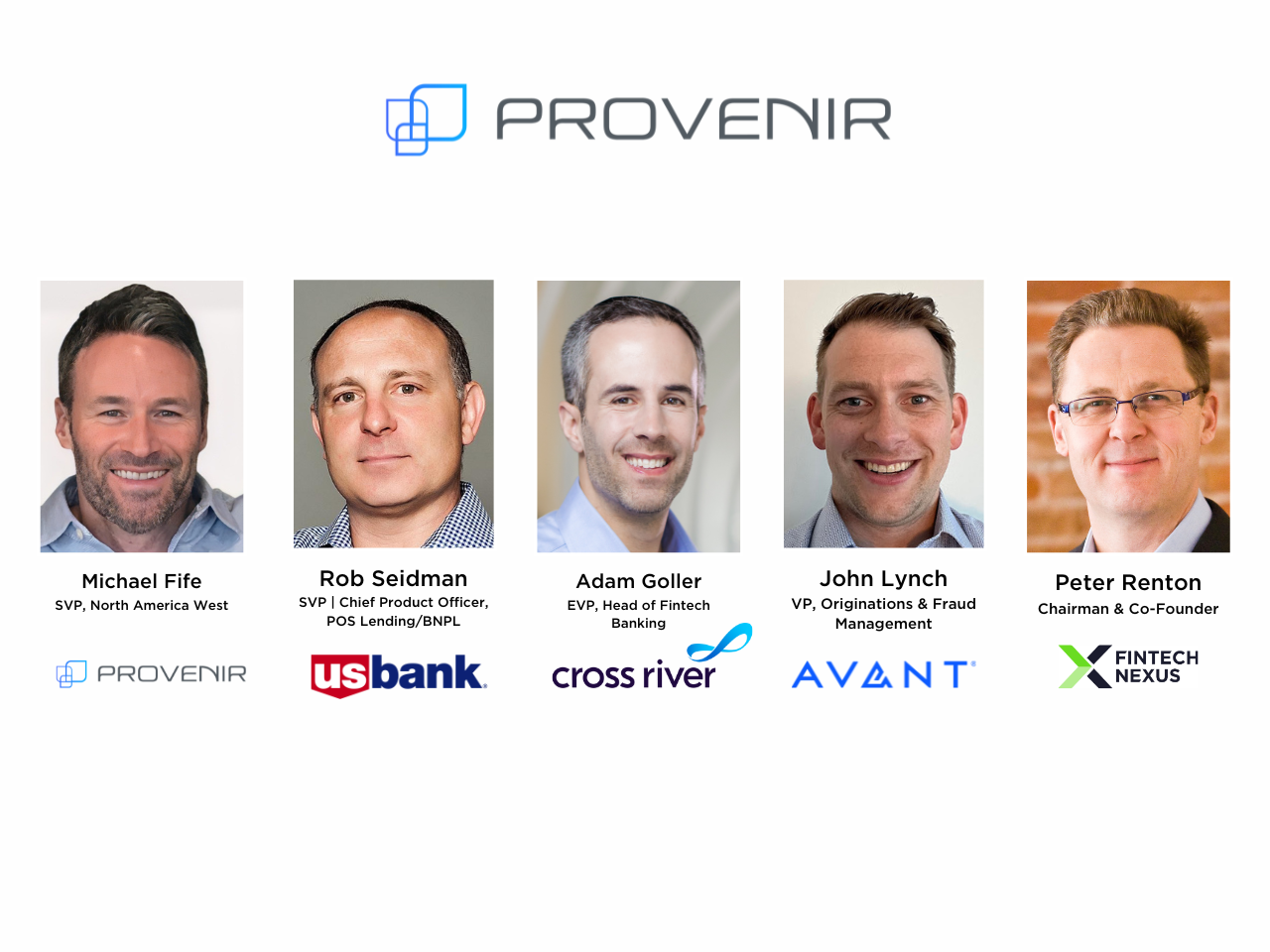

How Client Lenders Can Cut back Friction With out Compromising on Danger and Fraud Prevention

Mar 21, 2pm EDT

Buyer expertise is extremely essential to as we speak’s discerning customers, whether or not they’re searching for monetary companies…

Additionally Making Information

- USA: 8 of the largest points going through the banking business as we speak

A serious shake-up within the funds world, an information breach that’s opened up a debate on who’s finally answerable for cyberattacks, and uncertainty about the way forward for the Basel III endgame proposal are among the many points banks want to observe.

- UK: UK set for hovering digital pockets adoption

The UK is approaching a seismic shift in how individuals pay, with digital wallets set to comprise half of all e-commerce spend and practically a 3rd of POS transaction worth by 2027, in line with a report from Worldpay.

- USA: The Significance of Primacy in Banking

Within the face of accelerating acquisition challenges and rising attrition charges, retail banks should not solely concentrate on buying new prospects but additionally on

To sponsor our newsletters and attain 275,000 fintech fanatics together with your message, contact us right here.

[ad_2]