[ad_1]

Amazon founder Jeff Bezos not too long ago took a visit into house.

At exactly 8:12 a.m. Central Time, the rocket hooked up to his Blue Origin house capsule lit its engines. Bezos blasted upward, quickly reaching an altitude of 351,210 toes.

On the peak of his flight path, Bezos was weightless. He unstrapped himself, and for 3 wonderful minutes, he floated across the capsule and took within the extraordinary views of Earth and the universe.

The important thing to a profitable mission comparable to this one — the distinction between a joyful journey and loss of life — is precision.

That’s why the eleven-minute flight was choreographed to the second. And that’s why Bezos introduced alongside one thing particular on his journey, one thing he’d paid $6,000 for.

Are you able to guess what it’s?

“No one Leaves Dwelling With out One”

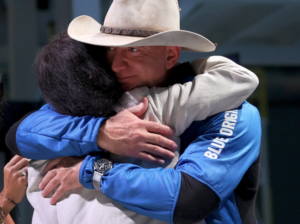

Right here’s an image of Bezos on the day of his mission into house:

Positive, you’ll be able to see the title of his firm on his shirt — Blue Origin.

However what else do you discover?

His watch!

It’s an Omega Speedmaster, the identical mannequin the Apollo 13 mission relied on in 1970.

Omega’s been making Swiss luxurious watches since 1848. In the present day, along with Bezos, its shoppers embody Elon Musk, who’s been seen sporting an Omega Seamaster Aqua Terra.

Bezos knew he’d be photographed extensively on at the present time, which explains why he’s sporting such a “assertion piece.”

Victoria Hitchcock, who advises the rich on style and private branding in Silicon Valley,

says folks within the tech business have not too long ago grow to be fixated on watches. As she wrote, “No one leaves residence with out one!”

For instance, Satya Nadella, the CEO of Microsoft, wears a Breitling Colt (about $3,100).

Mark Hurd, the co-CEO of Oracle, wears a Rolex Dayjust (about $7,100).

And Jeff Weiner, the CEO of LinkedIn, wears an Audemars Piguet Royal Oak (about $17,800).

Then there’s Oracle founder Larry Ellison. Within the image under, he’s sporting a Richard Mille RM 0029, which retails for about $170,000.

As Paul Altieri, founding father of a watch-resale market known as Bob’s Watches, stated: “Throughout sectors, professionals choose watches that broadcast their identification and aspirations. Watches stay profound private statements no matter whether or not one is creating software program or sealing a game-changing deal.”

With a lot cash being devoted to those assertion items, watches have grow to be an enormous enterprise, even their very own asset class.

That explains why so many odd persons are beginning to spend money on them, identical to they’d spend money on shares or bonds…

An Various to Shares and Bonds

To set the stage right here, let me clarify how most individuals make investments…

Most folk persist with shares, bonds, and ETFs. In the event that they’re adventurous, possibly they’ll add some bitcoin.

However the wealthy make investments otherwise. And this distinction may clarify why they preserve getting richer.

You see, in keeping with latest analysis from Motley Idiot, the wealthy primarily spend money on “various property.” What are these alternate options? Effectively, for starters, they embody non-public startups and personal actual property offers — the type we concentrate on right here at Crowdability.

However in addition they embody “collectibles” like artwork, baseball playing cards, and also you guessed it, watches.

As of 2020, the rich held about 50% of their property in these various investments, and simply 31% in shares. The rest was in bonds and money.

Why would they do such a factor? Let’s have a look.

Three Causes the Rich Put money into Options

For starters, investing in various property offers diversification. So even when the inventory market retains crashing prefer it’s been doing not too long ago, these property can continue to grow in worth.

Moreover, they provide a hedge towards inflation. In inflationary instances like we’re in as we speak, that’s a useful trick.

However maybe most essential of all, they’ll present market-beating returns.

For instance, over the past 25 years, early-stage startup investments have delivered annual returns of 55%. That’s about 10x increased than the historic common for shares.

And in the meantime, in keeping with the Motley Idiot, over the past decade:

- Wine has shot up 127% in worth.

- Traditional automobiles have gone up 193%.

- And uncommon whisky is up an astonishing 478%.

Watches, in the meantime, are in a league of their very own…

Watch Me

It’s common currently for classic watches to promote for tens of millions of {dollars}.

For instance:

- A Patek Phillipe Stainless Metal Grand Issues bought for $7.2 million. Acknowledged as some of the spectacular editions of the Grand Issues collection — it has a “Tourbillion,” a calendar with moon phases, and a Minute Repeater — this 2015 watch bought at public sale for 10x its lowest estimate.

- A Rolex “Paul Newman” Daytona bought for $17.7 million. Manufactured in 1968, the watch was a present to Paul Newman from his spouse. This one encompasses a distinctive dial design, with numerals for its seconds observe matched to its sub-dials.

- And a Patek Phillipe Grandmaster Chime bought for a whopping $31 million. This watch was designed for Patek Phillipe’s a hundred and seventy fifth anniversary. It took seven years and over 100,000 hours to create. It’s probably the most complicated Phillipe watch ever constructed, and it encompasses a particular inscription, “The Solely One.”

So how can you begin investing in watches like these — earlier than they grow to be so useful, and for simply a whole lot of {dollars} as an alternative of tens of millions?

Let’s have a look.

Investing in Collectibles

Lately, a brand new kind of web site has emerged to offer odd folks the flexibility to speculate small quantities of cash into all the things from wonderful wine to wonderful artwork.

Primarily, identical to you should buy a $100 stake in a startup, now you should buy $100 price of a classic Bordeaux, a traditional piece of artwork from Keith Haring, or a multi-million-dollar watch.

For instance, on Otis, you’ll be able to spend money on collectibles together with baseball playing cards, limited-edition sneakers, artwork, and watches.

And on Rally, you could find all the things from classic Porsches to one-of-a form choices just like the double-necked guitar utilized by Slash from Weapons N’ Roses. It additionally gives a secondary market, so you’ll be able to purpose to promote your investments at any time.

You may make investments no matter you’re snug with — $100 right here, $100 there — and when the merchandise sells, you obtain your income in relation to how a lot you set in.

On websites comparable to these, you could find watches from Rolex and Patek Phillipe, in addition to Jeff Bezos’ alternative, Omega. For instance, an Omega Seamaster that initially retailed for about $1,000 was not too long ago being supplied for $3,895 — giving its proprietor a possible revenue of about 289%.

Beware!

Take note, all the everyday caveats about investing apply right here:

For instance, don’t make investments greater than you’ll be able to afford to lose; spend money on what you understand; and make sure to dip your toe into the water earlier than diving in.

Moreover, many different investments aren’t solely “liquid.” Which means they’ll’t essentially be transformed into money on the snap of your fingers.

So don’t make investments your hire or grocery cash into these choices.

However in case you’re seeking to spend money on “assertion items” just like the wealthy, platforms comparable to Otis and Rally are a fantastic place to start out!

Glad Investing.

Finest Regards,

Founder

Crowdability.com

[ad_2]