[ad_1]

Outstanding crypto analytics agency Glassnode says Bitcoin is in a long-lasting uptrend powered by merchants who’re nonetheless doubting the energy of BTC.

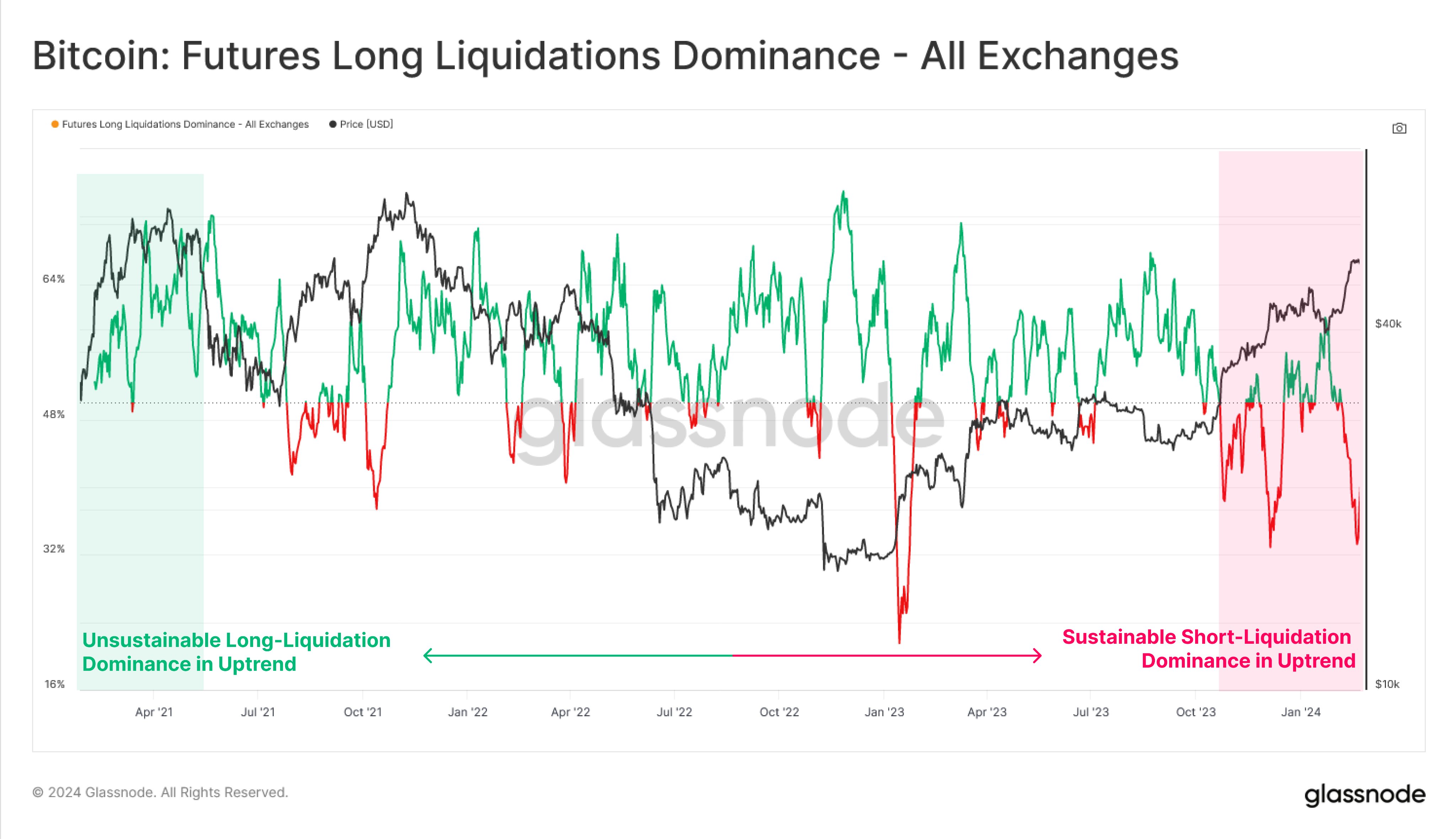

In a brand new publish on the social media platform X, the analytics agency says Bitcoin’s present bull run appears very totally different from the one witnessed in 2021 when BTC bulls have been utilizing extreme leverage to drive up the worth of the crypto king.

Based on Glassnode, bears who’re shorting BTC are getting liquidated, triggering brief squeezes and offering gas for Bitcoin rallies.

A brief squeeze occurs when merchants who borrow an asset at a sure value in hopes of promoting it for decrease to pocket the distinction are pressured to purchase again the property they borrowed as momentum strikes towards them, triggering additional rallies.

Says Glassnode,

“It’s price noting that at each Bitcoin ATH (all-time excessive) peaks in 2021, lengthy merchants dominated liquidation volumes, as leveraged positions have been force-closed inside the intra-day volatility.

As such, seeing such a robust dominance of directional brief merchants being liquidated suggests many merchants have been betting towards the prevailing uptrend since October.”

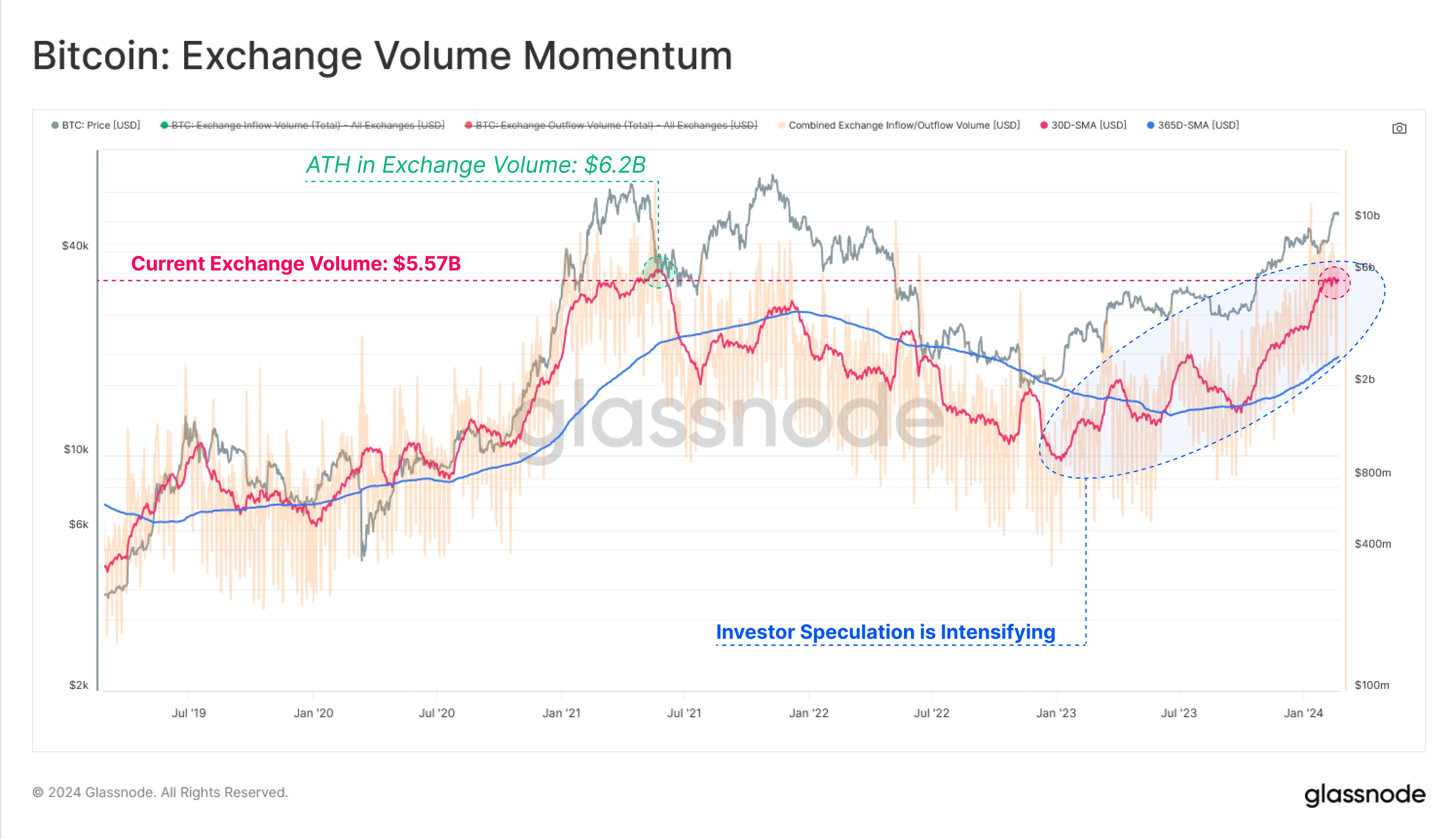

Glassnode additionally notes that Bitcoin is transferring out and in of crypto exchanges at a price harking back to November 2021, when BTC printed its all-time excessive of about $69,000.

“The full quantity of Bitcoin deposits and withdrawals to exchanges has continued to broaden, reaching a staggering $5.57 billion in day by day quantity flowing out and in of exchanges, rivaling exercise seen in the course of the November [2021] market all-time excessive.”

At time of writing, BTC is buying and selling at $61,825.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney

[ad_2]