[ad_1]

The primary week of 2024 marked a notable milestone in crypto asset investments. Funding merchandise on this specific sector witnessed inflows amounting to $151 million, in keeping with a current report from CoinShares.

Crypto Asset Funds Sees Surge In Inflows

This $151 million surge in influx, as highlighted by James Butterfill, Head of Analysis at CoinShares, is especially noteworthy in mild of the Grayscale vs. US Securities and Trade Fee (SEC) lawsuit, with these inflows contributing to a complete of $2.3 billion because the case started in October 2022.

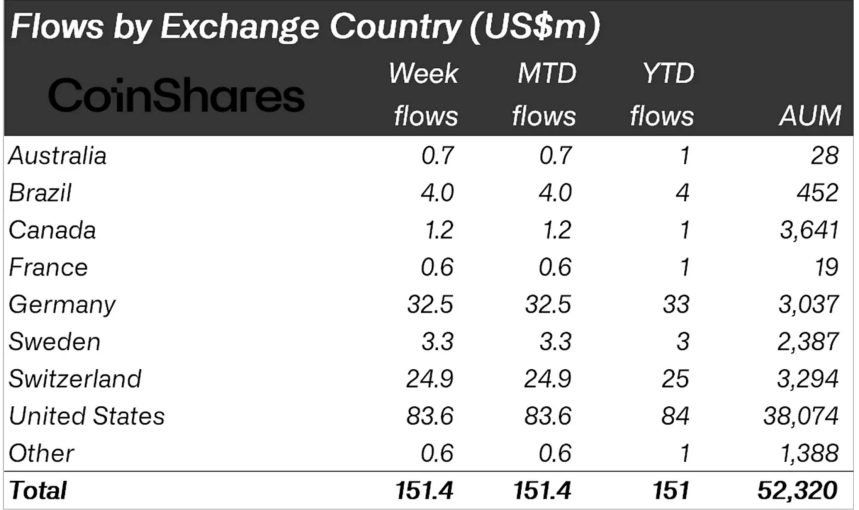

This quantity accounts for 4.4% of the agency’s complete managed property. Even with no spot exchange-traded fund (ETF) launch within the US, Butterfill revealed that American exchanges contributed to over half of those inflows, at 55%. German and Swiss exchanges adopted, contributing 21% and 17% of the inflows, respectively.

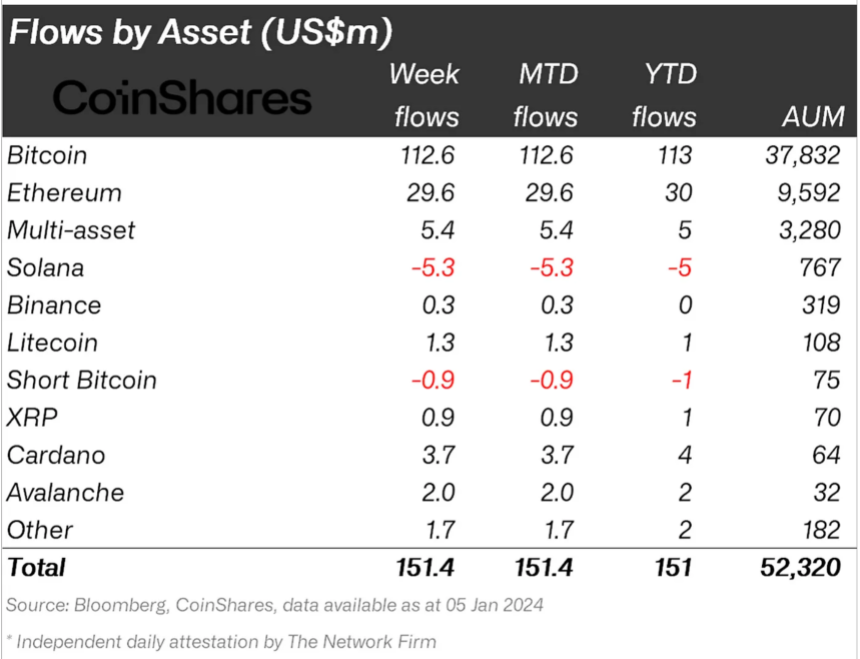

Bitcoin emerged because the chief in funding inflows, amassing $113 million. This substantial sum equates to three.2% of the entire property below administration (AuM) within the final 9 weeks.

James Butterfill identified an fascinating pattern that challenges the anticipation of the US SEC approval of a spot Bitcoin ETF being a “purchase the rumor, promote the information” occasion. Butterfill famous within the report:

If many really believed that launch of the [spot] ETF within the US would a “purchase the hearsay, promote the information” occasion, we certainly would count on to see inflows into short-bitcoin ETPs, as a substitute, outflows over the past 9 weeks have amounted to US$7m.

Notably, it’s because “purchase the rumor, promote the information” implies that buyers purchase property forward of an anticipated occasion (just like the spot ETF launch) and promote them when the precise occasion happens, typically resulting in a value decline.

Nevertheless, the statement right here by Butterfill is kind of the other. As an alternative of seeing inflows (extra funding) into short-Bitcoin exchange-traded merchandise (ETPs) (which profit from a decline in Bitcoin’s value), there have been outflows amounting to $7 million over the past 9 weeks.

This means that buyers won’t count on a big value drop following the spot Bitcoin ETF launch within the US, contradicting the “purchase the rumor, promote the information” expectation.

Ethereum And Altcoins: A Combined Bag Of Sentiments

Ethereum’s efficiency within the crypto asset funding area has additionally been noteworthy. The second-largest crypto by market cap noticed inflows of $29 million, with the final 9 weeks bringing in $215 million. This inflow signifies a big shift in investor sentiment in the direction of Ethereum.

Whereas Solana, then again, confronted outflows amounting to $5.3 million, Cardano, Avalanche, and Litecoin witnessed inflows. Cardano noticed $3.7 million, Avalanche $2 million, and Litecoin $1.4 million in inflows. The blockchain fairness sector additionally began the 12 months on a robust observe, recording inflows of $24 million previously week.

Regardless of Bitcoin’s dominance in inflows, the flagship crypto has just lately skilled a web outflow of $32.8 million, with brief Bitcoin funding merchandise additionally seeing a minor outflow final month.

Nevertheless, Bitcoin’s current $113 million influx has proven the asset’s transfer to rebound. Even in value efficiency, Bitcoin has elevated by 5.2% over the previous week and seems to be persevering with its upward trajectory by 1.1% within the first 24 hours, with its buying and selling value nearing the $45,000 mark.

Contrastingly, Ethereum, after a 2% decline over the previous week, is exhibiting indicators of restoration, rising by almost 1% previously day. Different altcoins similar to Solana, Cardano, Avalanche, and Litecoin have been much less lucky, experiencing important losses, with Avalanche and Cardano being the highest losers, down by 27.3% and 17% previously week.

Litecoin and Solana, although additionally within the purple, have seen barely lesser declines. Solana is down by 10% over the previous week and 1.6% previously 24 hours, whereas Litecoin mirrors this pattern, down by 10.8% over the week and 0.4% within the final day.

Featured picture from iStock, Chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site solely at your individual threat.

[ad_2]